More than 10 percent of the people Homeownership Advisor Ester Alfau-Compas meets with speak Spanish. But until recently, their only option for a homeownership education course approved by the U.S. Department of Housing and Urban Development (HUD) were to attend an on-demand Spanish version online or an in-person class in English.

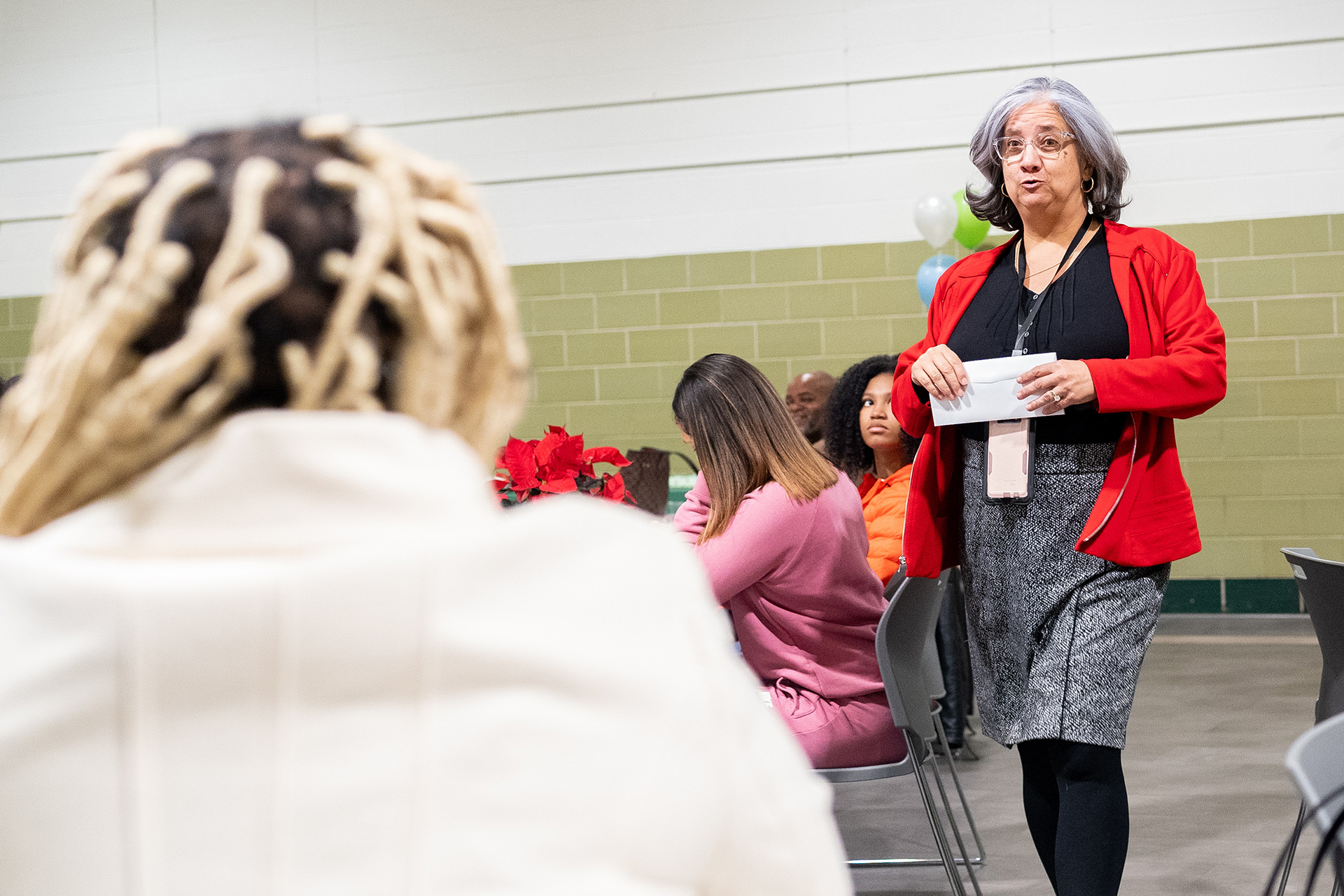

Now there’s an in-person Spanish option through Beyond Housing, the largest HUD-approved agency for homebuyer education and housing counseling in the metro area. The course—the first to be offered in Spanish by a HUD-approved agency in St. Louis—is led by Alfau-Compas, a bilingual, HUD-certified counselor with deep knowledge honed over many years of educating prospective homebuyers about the four Cs of homeownership: credit, capital, capacity, and collateral.

Although Alfau-Compas said all the information is the same between the English and Spanish versions, there are cultural nuances. For example, as someone who grew up in the Dominican Republic, she understands why immigrants might be reluctant to deposit money in banks or open a line of credit. “It’s a completely different banking system,” she pointed out.

“Spanish-speakers and English-speakers often have a different set of challenges,” Alfau-Compas continued. “Spanish-speakers tend to be very resourceful and good at managing money but need more information on using credit to their benefit.”

She and the course’s guest speakers use both Spanish and English acronyms and phrases when they go in-depth on topics such as lending and credit. “Prospective homebuyers may be familiar with financial terms in Spanish, but they need to know them in English too,” she explained.

Alfau-Compas said Spanish-speaking people make up a growing share of those who come to Beyond Housing for homeownership classes and counseling on how to obtain and sustain their homes. To spread the word about its new in-person Spanish-language homebuyer education courses, Beyond Housing recently joined the Hispanic Chamber of Commerce.

Participants are often referred by lenders and realtors—and some find out about Beyond Housing through social media and/or internet come from within Beyond Housing’s own 500 rental units.

One of the most common misconceptions Alfau-Compas encounters relates to who can buy a house in the U.S. “Many Spanish-speaking people feel that if they’re not a permanent resident or citizen, they cannot buy a house—and that’s not necessarily true,” she said. “If they’ve been working, reporting their income, and paying taxes, there’s a chance they can buy a house.”

The end of the year is a perfect time to start the homebuying education process, Alfau-Compas said. People may be more motivated to take initial steps toward applying for a mortgage such as modifying their tax withholding for the following year. “After that,” she said, “the timeline is a matter of how prepared and how dedicated they are..”

An overview of Beyond Housing’s homebuyer education course

- An introduction to Beyond Housing, its mission, and why it exists

- Establishing and rebuilding credit

- Money management and budgeting

- The mortgage loan approval process

- Aspects of real estate, including home inspection and homeowner’s insurance

- Home maintenance and protecting your investment.

More information—including the schedule and fees for Spanish-language classes—is available on the Homebuyer Education Program website.